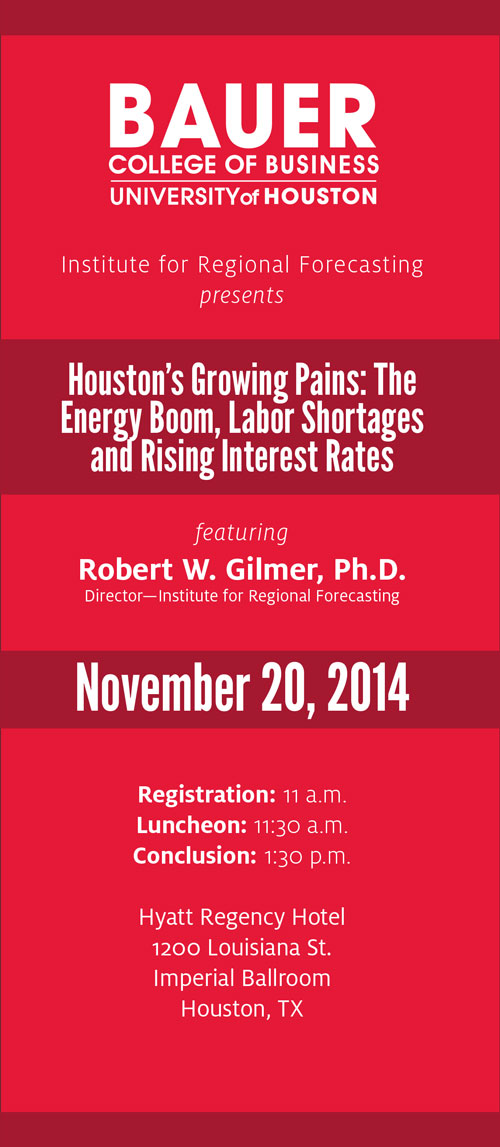

Fall 2014 Symposium

Thursday, November 20, 2014

"Houston's Growing Pains: The Energy Boom, Labor Shortages, and Rising Interest Rates"

Featuring: Robert W. Gilmer, Ph.D.

Director, Institute for Regional Forecasting

Event Details

Hyatt Regency Hotel (Imperial Ballroom), 1200 Louisiana, Houston, Texas 77002

Thursday, November 20, 2014

Luncheon & Presentation:

11:30 a.m. - 1:30 p.m.

Online registration is now closed, but if you'd like to attend we do have a limited number of seats available, but they must be purchased at the special assistance table at the symposium. At door registration fee is $125/seat payable with a check made payable to University of Houston.

See the Flyer

The Fall 2014 Symposium will update the status of Houston's ongoing energy boom, look closely at emerging strength in the U.S. economy and consider how the Federal Reserve will likely respond in 2015 with higher interest rates. We will pay particular attention to Houston’s real estate sector, the best example of a local industry clearly caught up in an evolving mix of energy-driven growth, serious labor shortages and soon-to-be-rising interest rates.

The Houston energy boom continues, leaving the local economy on a strong track. With help from the weather, upstream drilling rolls on, and the large downstream petrochemical and LNG construction projects are quickly moving forward. Looking backward, the historical employment data continues to be revised up, re-emphasizing the power of Houston’s recent oil-driven growth. Looking forward, and barring the unexpected, the key question simply becomes: How strong will the Houston economy be?

Meanwhile, the U.S. economy has shaken off the effects of a cold winter and despite an uneven recovery in housing, has moved onto a solid growth path. This is good news for Houston’s many companies that sell directly into U.S. markets. However, as U.S. labor markets tighten, it will only exacerbate a persistent and ongoing shortage of local workers in energy, engineering and especially construction.

And greater U.S economic strength almost certainly means higher interest rates for all of us. The Federal Reserve currently seems to be on a glide-path to end its quantitative easing program this fall, to raise short-term policy rates in mid-2015, and perhaps to begin shrinking its balance sheet soon after. Whatever the timing, the Fed will bring an array of new tools to achieve the lift-off in rates, and to keep rates rising over the next several years. How quickly and how far will policy rates move? How will Treasury and mortgage rates respond over the coming months and years?

A booming local real estate industry finds itself caught in the middle of all these changes. Riding the energy boom, by mid-year Houston had permitted 23,000 new single-family homes and 12,000 apartment units; 16 million square feet of office space was under construction, eight million of industrial space, and nearly three million of retail. We will review the status of each of these major sectors one by one, and consider how the changing landscape for energy, labor and interest rates affects the outlook for local real estate.

For more information concerning the symposium please view our flyer.